COBENEFITS Policy Report

COBENEFITS Policy Report Turkey

COBENEFITS Policy Report Turkey (Turkish version)

The Policy Report compiles key findings from our assessments and formulates policy actions to harness the social and economic co-benefits of renewables.

COBENEFITS Studies in Turkey

- Increasing industrial competitiveness and hedging against fossil price volatility with renewables in Turkey

- Industrial development, trade opportunities and innovation with renewable energy in Turkey

- Future skills and job creation through renewable energy in Turkey

- Improving people’s health and unburdening the health system through renewable energy in Turkey

- Securing Turkey’s energy supply security and balancing the current account deficit through renewable energy

More on Turkey

Main study results

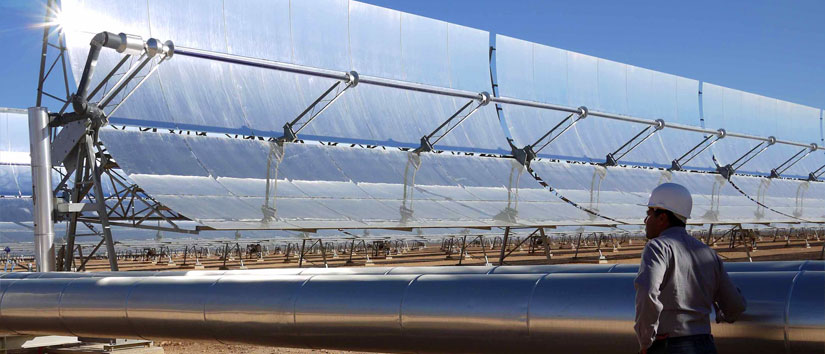

The studies show how the implementation of renewable energy resources can have a positive impact on job creation, industrial development, health and supply security.

Job creation

Turkey can significantly boost gross employment by increasing the share of renewables. Up to 61,400 full-time equivalent jobs (FTE employment2 ) in the solar sector and 147,700 in the wind sector can be created nationally through the power sector transformation between 2018 and 2028. Over that ten-year period each additional MW in wind energy production leads to increased employment of 6.3 full-time equivalent workers across the entire value chain. Across the solar value chain each additional MW leads to an increased employment of 2.5 fulltime equivalent workers. While the expected growth of Turkey’s wind and solar power producers will increase the demand for high-skilled jobs, middle-skilled workers are the main beneficiaries of job creation across the whole wind and solar value chains, with 55 % of job additions in this labour segment.

Industrial development and trade opportunities

Turkey, with its increasing energy demand met mostly by fossil fuel resources, faces significant risk of an escalation of its dependency degree on energy imports in the future. In order to address this issue, Turkey’s public policy framework includes not only strategies to increase the share of renewable energy resources in its energy mix but also aims to develop a local manufacturing industry and to enable technology transfer. By 2028 it is possible for the solar energy sector to increase its value by 9.9 billion USD above the expected 1.3 billion estimated under the current policy, if more ambitious solar capacity additions are achieved. Likewise, the wind sector could peak to a total value of 83.5 billion USD from the expected 33.32 billion USD in the next ten years should RE capacity additions are in place. Fostering competitiveness in manufacturing and closing the technology gap between imports and exports in both the solar and wind sectors is crucial to further improving the trade balance in Turkey’s renewable energy sector.

Health

Turkey can significantly reduce the number of premature deaths related to air pollution from fossil-fuelled power plants. 750 premature deaths can be avoided in the year 2028 by increasing the share of renewables in the power sector. Turkey can generate significant health cost savings by decarbonising the power sector. Health cost savings can amount to USD 800 million in the year 2028 alone. Asthma among children younger than 14 years can be reduced by almost 1 million cases in 2028.

Supply security

Turkey can foster its energy independence and ensure security of supply by increasing the use of its renewable energy sources. Increasing the share of renewable energy in power generation will contribute to increasing independence from fossil fuel imports and to reducing the current account deficit in the energy sector’s trade balance. By the year 2028 Turkey can reduce its natural gas consumption by 16£% and 155 million MMBTU (million British Thermal Units) through scaling up renewable power generation without the need to increase foreseen investment in the transmission system. Annual economic savings on fossil fuels and fossil fuel imports can amount to USD 2.1 billion by the year 2028 by increasing the share of renewable energy in power generation and making the transmission system renewables-ready.

COBENEFITS Council Members in Turkey

- Ministry of Energy and Natural Resources (MENR)

- Ministry of Environment and Urban Affairs (MoEU)

- Ministry of Treasury and Finance (MoTF, formerly Ministry of Economics MoE)

- Ministry of Foreign Affairs (MFA)

- Ministry of Health (MoH)

COBENEFITS Focal Point in Turkey

Istanbul Policy Center (IPC) is a Sabanci University policy research institution that specialises in key social and political issues ranging from democratisation to climate change, transatlantic relations, conflict resolution and mediation. Since its foundation in 2001, IPC has provided decision-makers, opinion leaders, and other major stakeholders with objective analyses and innovative policy recommendations. As an essential part of Sabanci University, IPC strives to foster academic research. The Center extends intellectual and substantive support to young academics and policy researchers through its various programmes.